UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:[ ] Preliminary Proxy Statement[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))[X] Definitive Proxy Statement[ ] Definitive Additional Materials[ ] Soliciting Material under ss. 240.14a-12

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to | |||

| CROWN HOLDINGS, INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

Payment of filing fee (check the appropriate box):

| ☒ | No fee required. | |

| ☐ |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act |

Crown Holdings, Inc.

Hidden River Corporate Center Two

14025 Riveredge Drive, Suite 300

Tampa, Florida 33637

________________________

NOTICE OF 20182023 ANNUAL MEETING OF SHAREHOLDERS

________________________

| Date: | April 27, 2023 | |

| Time: | 9:30 a.m. Eastern Time | |

| Place: | The Westin Tampa Waterside | |

| 725 South Harbour Island Boulevard, Tampa, FL 33602 | ||

| Agenda: | · | Election of Directors |

| · | Ratification of appointment of independent auditors for the fiscal year ending December 31, 2023 | |

| · | Advisory vote on a resolution to approve executive compensation for the Named Executive Officers as disclosed in this Proxy Statement | |

| · | Advisory vote on the frequency of future Say-On-Pay votes | |

| · | If properly presented, consideration of a Shareholder proposal seeking Shareholder ratification of termination pay | |

| · | Such other business as may properly come before the Annual Meeting | |

Only Shareholders of Common Stock of record as of the close of business on March 6, 20187, 2023, the record date for the Annual Meeting, will be entitled to vote.

| By Order of the Board of Directors | ||

| ADAM J. DICKSTEIN | ||

| Corporate Secretary | ||

Tampa, Florida

March 19, 2018

| NOTE: | THE HEALTH AND WELL-BEING OF OUR EMPLOYEES AND SHAREHOLDERS IS OUR TOP PRIORITY. SHOULD WE DETECT A HEALTH RISK, WE MAY MODIFY THE ARRANGEMENTS FOR THE ANNUAL MEETING. IF WE TAKE THIS STEP, WE WILL ANNOUNCE ANY CHANGES IN ADVANCE IN A PRESS RELEASE AVAILABLE ON OUR WEBSITE AND FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) AS ADDITIONAL PROXY MATERIALS. PLEASE GO TO WWW.CROWNCORK.COM/INVESTORS/GOVERNANCE/PROXY-ONLINEFOR FURTHER DETAILS. |

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Bebe Held on April 26, 2018:

The Proxy Statement and Proxy Card relating to the Annual Meeting of Shareholders

and the Annual Report to Shareholders are available at

WWW.CROWNCORK.COM/INVESTORS/GOVERNANCE/PROXY-ONLINE

TABLE OF CONTENTS

| 2023 Proxy Statement Summary | 1 |

| Questions & Answers about the 2023 Annual Meeting | 14 |

| Proposal 1: Election of Directors | 20 |

| Director Compensation | 25 |

| Common Stock Ownership of Certain Beneficial Owners, Directors and Executive Officers | 27 |

| 2022 Say-On-Pay Vote Results | 36 |

| At-Risk Compensation | 37 |

| Pay-for-Performance Alignment - | |

| Performance-Based Compensation | 38 |

| Role of the Compensation Committee | 38 |

| Compensation Philosophy and Objectives | 38 |

| Committee Process | 39 |

| Role of Executive Officers in Compensation | |

| Decisions | 40 |

| Executive Compensation Consultant | 40 |

| Use of Benchmarking | 40 |

| Peer Group Composition | 40 |

| Compensation Strategy for CEO | 41 |

| Compensation Strategy for NEOs other than the CEO | 42 |

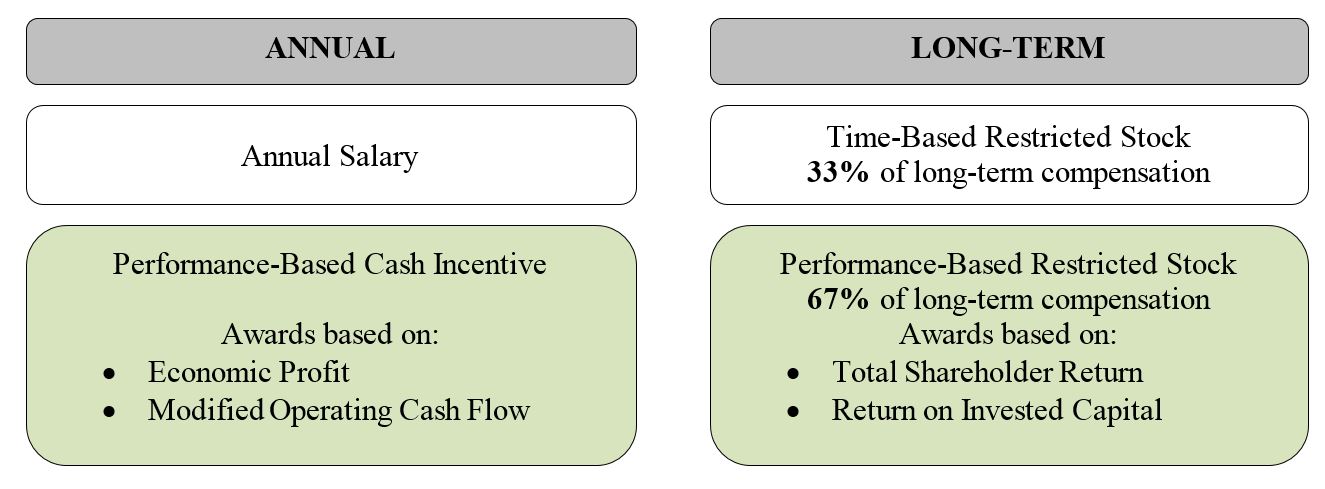

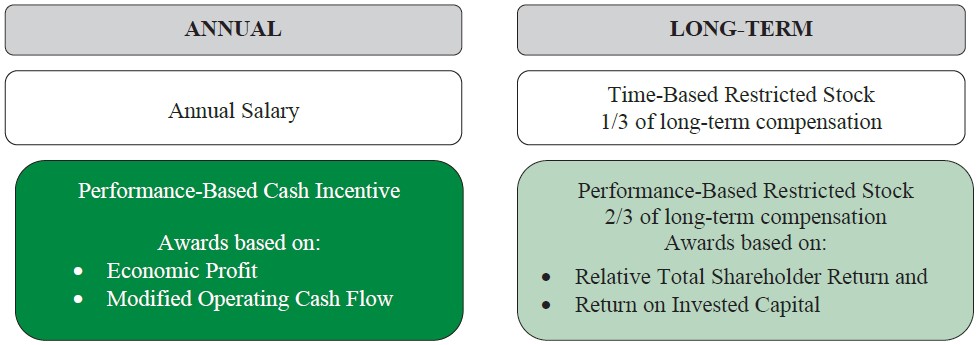

| Components of Compensation | 43 |

| Base Salary | 43 |

| Annual Incentive Bonus | 43 |

| Long-Term Equity Incentives | 46 |

| Retirement Benefits | 51 |

| Perquisites | 52 |

| Severance | 52 |

| Tax Deductibility of Executive Compensation | 52 |

| Summary Compensation Table | 54 |

| Grants of Plan-Based Awards | 56 |

| Outstanding Equity Awards at Fiscal Year-End | 58 |

| Option Exercises and Stock Vested | 60 |

| Pension Benefits | 61 |

| Employment Agreements and Potential Payments upon Termination | 62 |

| Pay Ratio Disclosure | 65 |

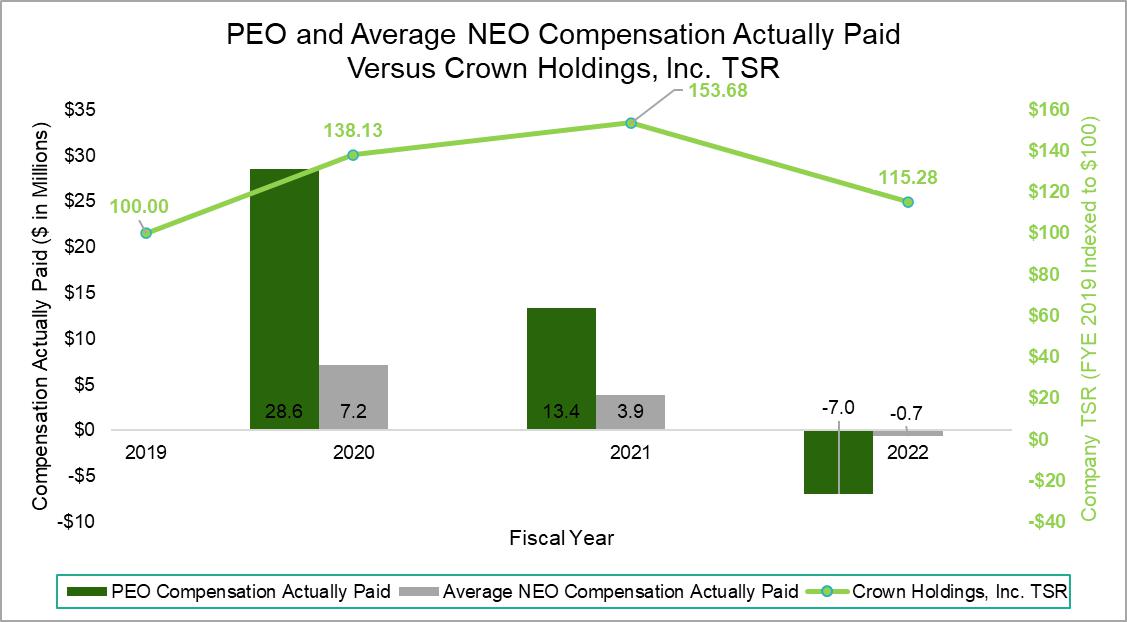

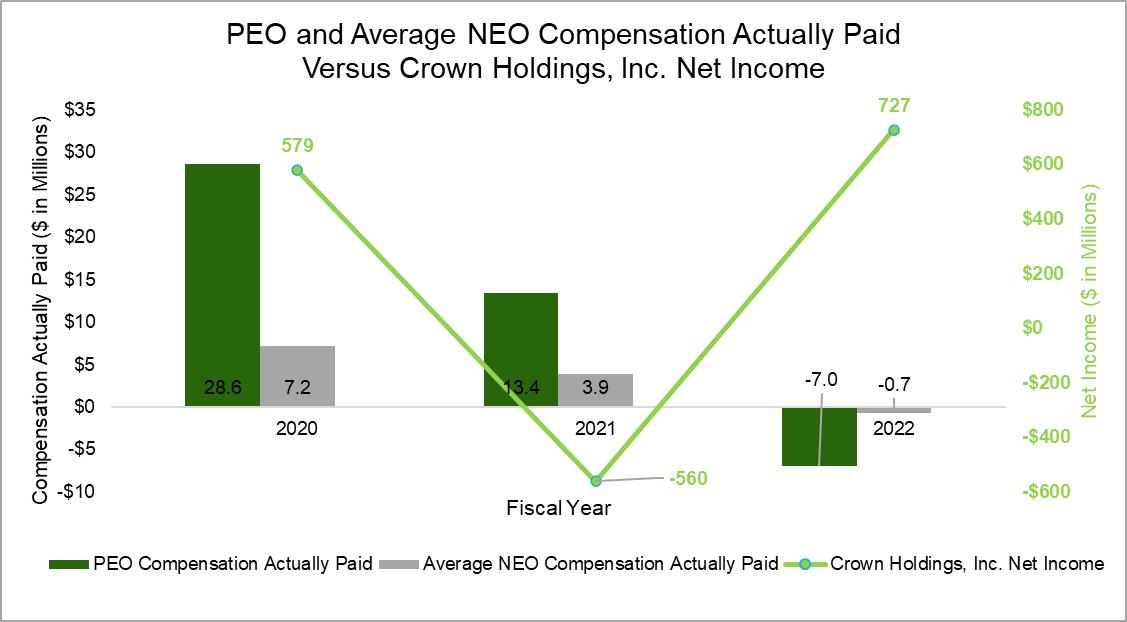

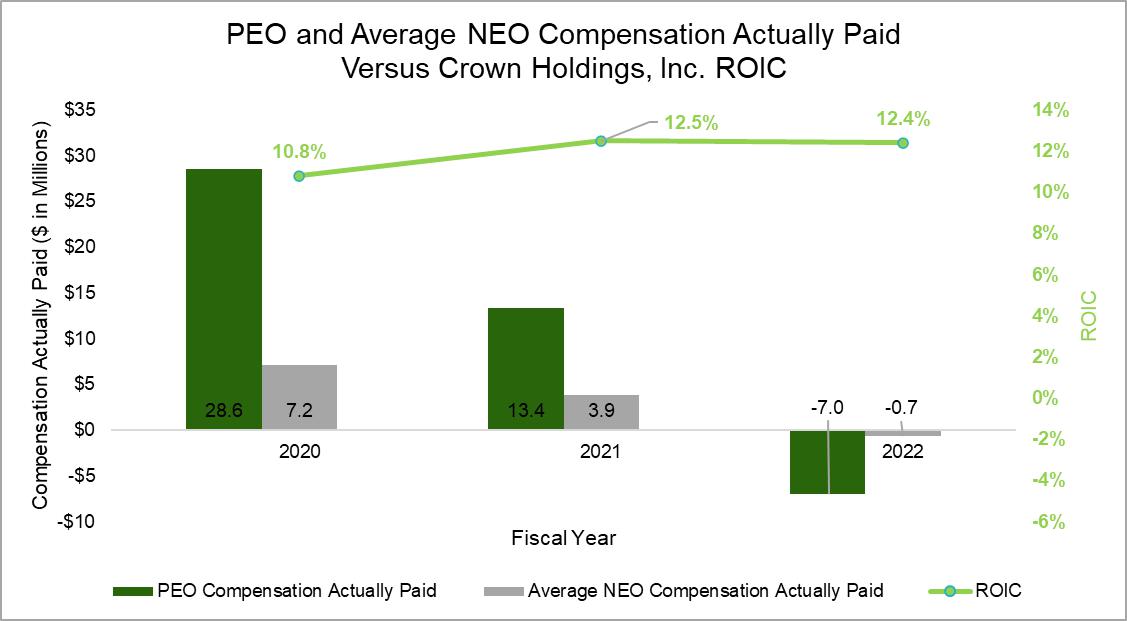

| Pay Versus Performance Disclosure | 65 |

2023 PROXY STATEMENT SUMMARY

This is a summary only and does not contain all of the information that you should consider. We urge you to carefully read the entire Proxy Statement before voting.

Crown Holdings, Inc. - 20182023 Annual Meeting

Time and Date: | 9:30 a.m. |

Place: | |

| 725 South Harbour Island Boulevard | |

| Tampa, Florida 33602 | |

Record Date: | March close of business on the Record Date will be entitled to vote at the Annual Meeting. |

2023 Annual Meeting Proposals

| Agenda Item | Board Recommendation | Page |

| 1. Election of Directors | FOR EACH DIRECTOR NOMINEE | |

| 2. Ratification of appointment of Independent Auditors | FOR | |

| 3. Advisory vote to approve executive compensation | FOR | |

| 4. Advisory vote on frequency of future Say-On-Pay votes | EVERY YEAR | 76 |

| 5. Consideration of Shareholder proposal | AGAINST |

How to Cast Your Vote

You can vote by any of the following methods:

Internet | Phone | In Person | ||||

|

|

|

| |||

|  |  |  | |||

www.proxypush.com/cck Deadline for voting online is 11:59 p.m. | 1-866-883-3382 Deadline for voting by phone is 11:59 p.m. | Mark, sign and date your proxy card and return it in the postage-paid envelope provided. Your proxy card must be received before the Annual Meeting. | For instructions on attending the Annual Meeting, please see about the |

| 1 |

Proposal 1 –- Election of Directors

There are twelvethirteen nominees for election to the Board of Directors. AdditionalAll of the nominees currently serve on the Board. Eight of the Company’s independent Directors have joined the Board in the last five years as a result of a Board refreshment process where Director candidates were identified through Board, Shareholder and third-party search firm input. Our Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. On December 12, 2022, the Company entered into a Director Appointment and Nomination Agreement with Carl C. Icahn and the affiliated persons and entities listed therein (collectively, the “Icahn Group”), pursuant to which the Company agreed to (i) increase the size of the Board of Directors of the Company to 13 directors and (ii) appoint Andrew J. Teno and Jesse A. Lynn (collectively, the “Icahn Designees”) to the Board to fill the resulting vacancies, and include each of the Icahn Designees as part of the Company’s slate of nominees for election to the Board at the 2023 Annual Meeting of Shareholders. Each Director nominee is listed below, and you can find additional information onabout each nominee may be found under Proposal 1 -1: Election of Directors, beginning on page 16.

Committee Memberships | ||||||||||||||||||||

Name and Primary Occupation | Age | Director Since | Independent | AC | CC | NCG | EC | |||||||||||||

John W. Conway Chairman of the Board of the Company | 72 | 1997 | No | Chair | ||||||||||||||||

Timothy J. Donahue President and Chief Executive Officer of the Company | 55 | 2015 | No | ✓ | ||||||||||||||||

Arnold W. Donald President, Chief Executive Officer and Director of Carnival Corporation | 63 | 1999 | Yes | ✓ | ||||||||||||||||

Andrea J. Funk Former Chief Executive Officer of Cambridge-Lee Industries | 48 | 2017 | Yes | ✓ | ||||||||||||||||

Rose Lee President of DuPont Safety & Construction | 52 | 2016 | Yes | ✓ | ||||||||||||||||

William G. Little Former Chairman and Chief Executive Officer of West Pharmaceutical Services | 75 | 2003 | Yes | ✓ | Chair | ✓ | ||||||||||||||

Hans J. Löliger Vice Chairman of GTF Holding | 75 | 2001 | Yes | Chair | ✓ | ✓ | ||||||||||||||

James H. Miller Former Chairman and Chief Executive Officer of PPL Corporation | 69 | 2010 | Yes | ✓ | ||||||||||||||||

Josef M. Müller Former President of Swiss Association of Branded Consumer Goods "PROMARCA" | 70 | 2011 | Yes | ✓ | ✓ | |||||||||||||||

Caesar F. Sweitzer Former Senior Advisor and Managing Director of Citigroup Global Markets | 67 | 2014 | Yes | Chair | ||||||||||||||||

Jim L. Turner Principal of JLT Beverages; Chairman of Dean Foods | 72 | 2005 | Yes | ✓ | ✓ | |||||||||||||||

William S. Urkiel Former Senior Vice President and Chief Financial Officer of IKON Office Solutions | 72 | 2004 | Yes | ✓ | ✓ | |||||||||||||||

Director |

| Committee Memberships | ||||||||||||

| Name and Primary Occupation | Age | Since | Independent | A | C | E | NCG | |||||||

Timothy J. Donahue Chairman, President and Chief Executive Officer of the Company | 60 | 2015 | No | ✓ | ||||||||||

Richard H. Fearon Former Vice Chairman and Chief Financial and Planning Officer of Eaton Corporation | 66 | 2019 | Yes | ✓ | ✓ | |||||||||

Andrea J. Funk Executive Vice President and Chief Financial Officer of EnerSys | 53 | 2017 | Yes | ✓ | ✓ | |||||||||

Stephen J. Hagge Former President and Chief Executive Officer of AptarGroup | 71 | 2019 | Yes | Chair | ✓ | ✓ | ||||||||

Jesse A. Lynn General Counsel of Icahn Enterprises and Chief Operating Officer of Icahn Capital | 52 | 2022 | Yes | ✓ | ||||||||||

James H. Miller Former Chairman and Chief Executive Officer of PPL Corporation | 74 | 2010 | Yes | ✓ | ✓ | Chair | ||||||||

Josef M. Müller Former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 75 | 2011 | Yes | ✓ | ✓ | |||||||||

B. Craig Owens Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company | 68 | 2019 | Yes | Chair | ✓ | |||||||||

Angela M. Snyder Senior Executive Vice President/Chief Banking Officer of Fulton Bank | 58 | 2022 | Yes | ✓ | ||||||||||

Caesar F. Sweitzer Former Senior Advisor and Managing Director of Citigroup Global Markets | 72 | 2014 | Yes | ✓ | ✓ | ✓ | ||||||||

Andrew J. Teno Portfolio Manager of Icahn Capital | 37 | 2022 | Yes | ✓ | ✓ | |||||||||

Director |

| Committee Memberships | ||||||||||||

| Name and Primary Occupation | Age | Since | Independent | A | C | E | NCG | |||||||

Marsha C. Williams Former Senior Vice President and Chief Financial Officer of Orbitz Worldwide | 71 | 2022 | Yes | ✓ | ||||||||||

Dwayne A. Wilson Former Senior Vice President of Fluor Corporation | 64 | 2020 | Yes | ✓ | ||||||||||

A: Audit Committee

The Board elected Mr. Timothy Donahue as its Chairman following the 2022 Annual Meeting. Mr. James Miller is the Board’s Independent Lead Director. See the section below titled “Corporate Governance: Board Leadership and Risk Oversight” for a summary of the duties of our Independent Lead Director.

| Less than 6 years | 6 – 10 years | More than 10 years | ||

|

|

| ||

|   |       | ||

Ongoing Board Refreshment – eight new Directors in five years | ||||

| Board Independence and Diversity | |

| Board Diversity ·Three female Directors ·One African American Director ·One non-U.S. citizen Director |

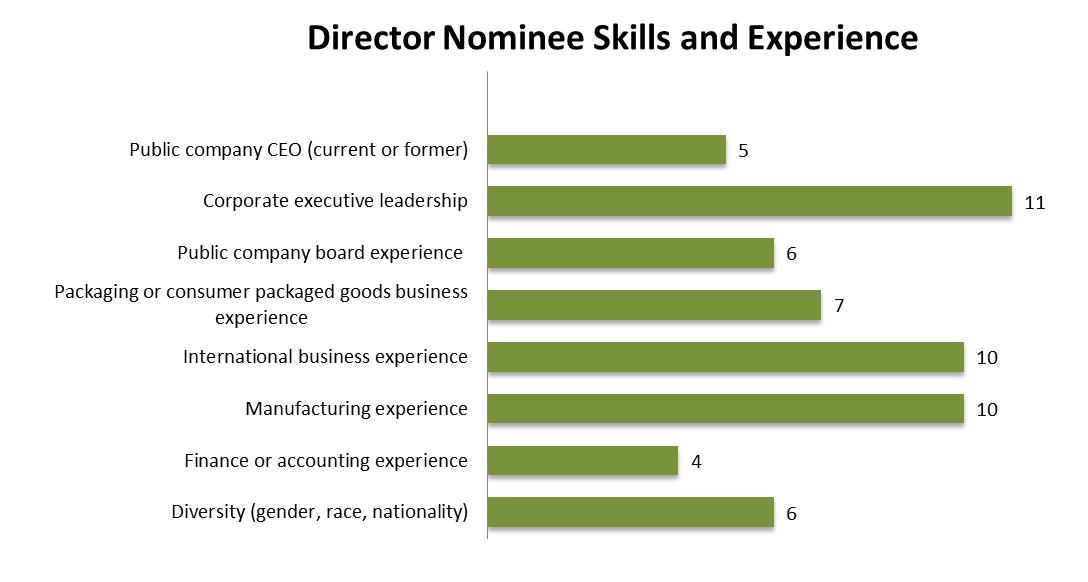

The twelvethirteen Director nominees standing for reelection to the Board have diverse backgrounds, skills and experiences. We believe their varied backgrounds contribute to an effective and well-balanced Board that is able to provide valuable insight to, and effective oversight of, our senior executive team.

| 3 |

|

| 4 |

Governance Best Practices

The Board of Directors is committed to implementing and maintaining strong corporate governance.governance practices. The Board continually monitorsadopts emerging best practices in governance to bestthat enhance the effectiveness of the Board and our management and that serve the best interests of the Company'sCompany’s Shareholders. The Corporate Governance section beginning on page 2430 describes our governance framework. We call your attention to the following best practices.

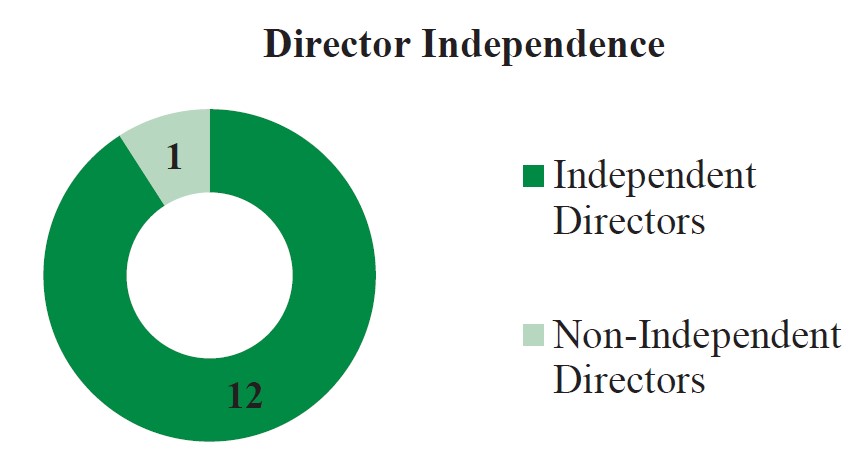

üAnnual election of all Directors üResignation policy applicable to Directors who do not receive a majority of votes cast in uncontested elections üMandatory retirement policy for Directors üProxy access üActive outreach and engagement üOverboarding limits üRobust Board refreshment with eight new independent Directors joining the Board in the last five years ü12 of üIndependent üExecutive sessions of üAnnual review of Committee charters and Corporate Governance Guidelines üRobust stock ownership guidelines for Directors and Named Executive Officers üProhibition on all pledging and hedging of the üAnnual Say-on-Pay vote üCode of Business Conduct and Ethics that applies to Directors and employees üNo supermajority voting requirement to amend By-Laws üShareholder right to call special meetings üNo poison pill üOversight of sustainability/environmental, social and governance (“ESG”) policy matters assigned to Nominating and Corporate Governance Committee and oversight of ESG disclosures and reporting assigned to Audit Committee üIntegration of Diversity and Inclusion in the Company’s Sustainability program, overseen by the Nominating and Corporate Governance Committee üBoard oversight of information security |

Shareholder Engagement

The Company has developed a multi-platform Shareholder engagement program that results in active dialogue with both current and prospective global Shareholders.investors globally. Major elements of the program include individual or group investor meetings, scheduled teleconferences, participation in sponsored institutional investor conferences and investor visits to Company manufacturing, research and development or administrative facilities. Subjects of discussion at these events include long-term strategy, historical and pro forma financial information, recent and pending acquisitions and divestitures, major trends and issues affecting the Company'sCompany’s businesses, industry dynamics, executive compensation, sustainability and corporate governance, among other matters. Every few years, as appropriate, the Company hosts investor day events, which may also include facility tours. The Company has recently

| 5 |

increased its efforts to cultivate relationships with the respective stewardship teams of its index-based Shareholders. In discussions with current and prospective Shareholders, our Shareholder engagement includes eliciting Shareholder perspectives on our business portfolio and capital allocation policies, among other matters. During last year'syear’s engagement cycle, we estimate that we had personal contact with investors owning well over 50%60% of the Company'sCompany’s outstanding shares.

Sustainability – Environmental and Social Responsibility

Sustainability continues to be a central motivating factor in and focus of the Company’s business strategy. Under the Board’s general direction the Nominating and Corporate ResponsibilityGovernance Committee reviews and assesses the Company’s Sustainability

In 2020, Crown established its comprehensive Twentyby30TM program, setting 20 measurable goals that the Company would attempt to reach by 2030 or sooner. These objectives encompass multiple aspects of sustainability and reflect areas which may be material to the Company'sCompany’s business strategy. We operate with a relentlessas well as areas where it believes it can create notable impact. Structured within five core program pillars of: Climate Action, Resource Efficiency, Optimum Circularity, Working Together and Never Compromise, these initiatives include efforts such as making operational improvements in energy, water and waste and elevating our focus on safety, innovationmaterial use efficiency, recycling, responsible and efficiency – both in our manufacturing processesethical sourcing and our use of resources. That discipline has enabled us to reduce our overall energy consumptionfood contact and greenhouse gas emissions, even as demand for metal packaging has continued to increase and we have grown our global footprint to best support our regional and international customers. Our focus on sustainability is aided by the strong recyclability credentials ofsafety.

The Company’s main raw material inputs, aluminum and steel, our primary raw materials. Our containersoffer unparalleled sustainability credentials for packaging not only due to their superior recycling rates and recycled content, but also because both materials are produced from permanent materials such as aluminum and iron ore thatinfinitely recyclable, meaning they can be infinitely recycled repeatedly with no loss of physical properties. These natural elements maintain their properties forever, making metal a key contributor to the circular economy. or quality. This constant reuse into new containers or other metal products saves raw materials, and energy and reduces CO2 emissions. Most of the products made by the Company’s Transit Packaging Division use a high degree of recycled content, with many using 100% recycled content. In fact, the group recycles hundreds of millions of pounds of plastic every year for use in its products. The Transit Packaging Division also produces reusable top frames, which contribute to a lower carbon footprint.

Crown recognizes that its sustainability journey depends on others within the value chain. The Company works to positively influence its upstream value chain through its written environmental supplier standards, which all suppliers are expected to follow and which provide oversight of and visibility into suppliers’ environmental management. Third-party risk assessments and off-site audits help to ensure sustainability is prioritized in our raw materials as the business works to improve all points of product lifecycles.

| 6 |

The Company issued its most recent biennialcomplete Sustainability Report in 2017.August 2022. The report uses the Global Reporting Initiative's (GRI) G4Initiative’s 2016 guidelines and is available in full at

| · | An 11% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions from the 2019 baseline |

| · | A 1.5% reduction in volatile organic compounds (VOCs) per unit produced |

| · | Improving the percentage of total electricity used by the Company coming from renewable resources to 30% |

| · | A 3.6% overall reduction in water used |

| · | An overall 4% reduction in 12 oz. or 330 ml can weights |

| · | A 99% diversion of waste sent to landfill |

| · | An 8% reduction in Total Recordable Incident Rate (TRIR) |

Some additional highlights from our 2017recent sustainability engagements are as follows:

| · | The Company committed to The Climate Pledge, targeting to achieve net-zero carbon emissions by 2040, a full 10 years ahead of the Paris Agreement goals. This commitment accelerated the Company’s existing RE100 goals, with a new target of achieving 100% renewable electricity by 2040, which is also 10 years sooner than required by previous commitments. |

| · | ESG ratings provider Sustainalytics ranked Crown as a Low ESG Risk Rating for managing ESG risk within the metal and glass packaging subindustry. For the third year in a row, Sustainalytics ranked Crown as a leader in the top 3% of the containers and packaging industry in 2022, with more than 100 global companies reviewed. |

| · | In 2022, Crown’s North American Beverage Packaging business ranked within the U.S. Environmental Protection Agency’s (EPA) Top 25 Green Power Partners from the Fortune 500 list for the second consecutive year, demonstrating a commitment to advancing the green power market. |

| · | For the second year in a row, Crown was named to the 100 Best Corporate Citizens of 2022 list by 3BL Media, headlined by its strong performance in the Climate Change pillar, within which it ranked in the top ten. |

| · | Crown was named to the America’s Most Responsible Companies 2023 list by Newsweek, in partnership with global research and data firm Statista. The list draws from an initial pool of 2,000 eligible U.S.-based companies and selects 500 finalists that demonstrate outstanding efforts relating to corporate social responsibility and sustainability. |

| · | In 2022, Crown was ranked in the top 100 companies included in Forbes’ inaugural “World’s Top Female-Friendly Companies” list, which evaluates employers on criteria including parental leave, promotion of gender equality and representation at equity board levels. |

| 7 |

The Company has also taken further steps in its sustainability efforts, including the following:

| · | In 2022, Crown hosted the beverage can industry’s first Global Aluminium Can Sustainability Summit in partnership with Ardagh Metal Packaging, the Can Manufacturers Institute and the International Aluminium Institute. The Summit brought together over 100 global attendees from various parts of the aluminum supply chain and facilitated important discussions aimed at driving actionable progress toward the industry’s sustainability goals. |

| · | Crown received certification from the Aluminium Stewardship Initiative (ASI) for its Mexican beverage can operations in 2022. ASI verifies responsible production, sourcing and stewardship of aluminum in the region. The Company achieved certification by the ASI Chain of Custody (CoC) Standard in Brazil, and is pursuing ASI certification in Mexico and within all Asian and Europe/Middle Eastern beverage can operations. The Company’s Brazil beverage can operation recently completed its own ASI Performance Standard. |

| · | The Company set ambitious new global recycling rates and recycled content goals for aluminum beverage cans, committing to work with industry partners to expedite progress aligned with its Twentyby30 program. The new targets include reaching a 70% target recycling rate in the U.S. and an 80% target rate in EMEA; maintaining rates of greater than 90% in Mexico and greater than 97% in Brazil by 2030; and establishing 2030 rate goals for Asia Pacific by 2025. |

| · | In 2022, Crown signed on to the United Nations (UN) Global Compact, a voluntary initiative based on CEO commitments to implement universal sustainability principles and take steps to support UN goals. |

| · | The Company reported under the Sustainability Accounting Standards Board (SASB) methodology and made disclosures in line with the Task Force on Climate-Related Financial Disclosures (TCFD) framework in its 2021 Sustainability Report, published in August 2022. |

The Company’s next Sustainability Report will be issued in 2023 and will use the Global Reporting Initiatives 2021 guidelines, which are as follows:

Information Security

The Company places a high priority on securing its confidential business information, as well as the confidential business information and personal information that we receive from and store about our business partners and employees.

The Company has systems in place to securely receive and store information and to detect, contain, and respond to data security incidents. The Company has information security compliance procedures in place to manage information security risk and runs a training program for those Company employees who have access to further increase transparency with customersconfidential information. This program provides training at least annually on information security. To respond to the threat of security breaches and other important stakeholders. Our last two annual submissions have received high rankings, placing us incyberattacks, the "Leadership" tier.

| 8 |

of 2020. Asany material information security incident. The Company undergoes annual third-party security penetration testing to gain an independent view of December 31, 2016, we are more than halfway towards achieving this goal, with greenhouse gas emissions reduced by 6.25% per billion standard units.

The Board, the Audit Committee and green manufacturing.

Proposal 2 – Ratification of Appointment of Independent Auditors

As a matter of good corporate governance, we are asking youthe Company asks its Shareholders to ratify the selection by the Audit Committee of PricewaterhouseCoopers LLP ("PwC"(“PwC”) as ourthe Company’s independent auditors for 2018.2023. The following table summarizes the fees PwC billed to the Company for 2017.

Audit Fees | Audit-Related Fees | Tax Compliance Fees | Tax Advisory Services Fees | All Other Fees |

| $6,204,000 | $830,000 | $290,000 | $1,599,000 | $102,000 |

| Audit Fees | Audit-Related Fees | Tax-Related Fees | All Other Fees |

| $7,923,208 | $687,703 | $1,458,229 | $12,305 |

Additional information in the section titled "Principal“Principal Accountant Fees and Services"Services” and the Audit Committee Report may be found on pages 5872 and 59.73.

| 9 |

Proposal 3 – Advisory Vote to Approve Executive Compensation

At the 20172022 Annual Meeting, the say-on-paySay-on-Pay resolution with respect to 2016 Named Executive Officer ("NEO"(“NEO”) compensation received a favorable vote of over 95%94%. Accordingly, the general approach to the compensation of theour NEOs, including the Chief Executive Officer ("CEO"(“CEO”), remained largely unchanged. For 2022, we added a sustainability criterion for the Board’s annual evaluation of the CEO. See the Compensation and Discussion Analysis ("(“CD&A"&A”) section that begins on page 28.36. Below is a summary of the CEO'sCEO’s compensation for 20162020, 2021 and 2017, Mr. Donahue's first two years serving as CEO.2022. Compensation of Mr. Donahue and the other NEOs is more fully described in the Summary Compensation Table on page 46.

| Name and Position | Year | Salary | Grant Date Projected Value of Unvested Restricted Stock Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value | All Other Compensation | Total Realizable Compensation(1) | Total Actual Realized Compensation(2) |

Timothy Donahue President and Chief Executive Officer | 2017 | $1,000,000 | $5,200,004 | $2,295,600 | $2,810,148 | $634,208 | $11,939,960 | $8,500,616 |

| 2016 | 915,000 | 5,051,113 | 2,594,849 | 1,994,476 | 419,188 | 10,974,626 | 6,974,883 |

| Name and Position | Year | Salary | Grant Date Projected Value of Unvested Restricted Stock Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value | All Other Compensation | Total Compensation |

Timothy Donahue President and Chief Executive Officer | 2022 | $1,315,000 | $7,364,000 | $599,969 | $0 | $21,167 | $9,300,136 |

| 2021 | 1,260,000 | 6,368,770 | 3,024,000 | 1,106,979 | 55,316 | 11,815,065 | |

| 2020 | 1,200,000 | 6,239,951 | 2,880,000 | 5,714,297 | 1,486,791 | 17,521,039 |

This year’s Change in Pension Value was a decrease, which is presented here as $0. The lump-sum present value calculations required to be included for Performanceall of our NEOs in this Proxy Statement for certain components of Total Compensation (e.g., Changes in Pension Value) are affected strongly by interest rates. Future changes in interest rates could cause significant changes in the lump-sum value of such benefits. See page 61, footnote 4, for more information about interest rate sensitivity. Note also that not all of the pension benefits payable to our NEOs will be paid in a lump sum.

Pay-for-Performance Alignment – NEO Forfeiture of Performance-Based Shares

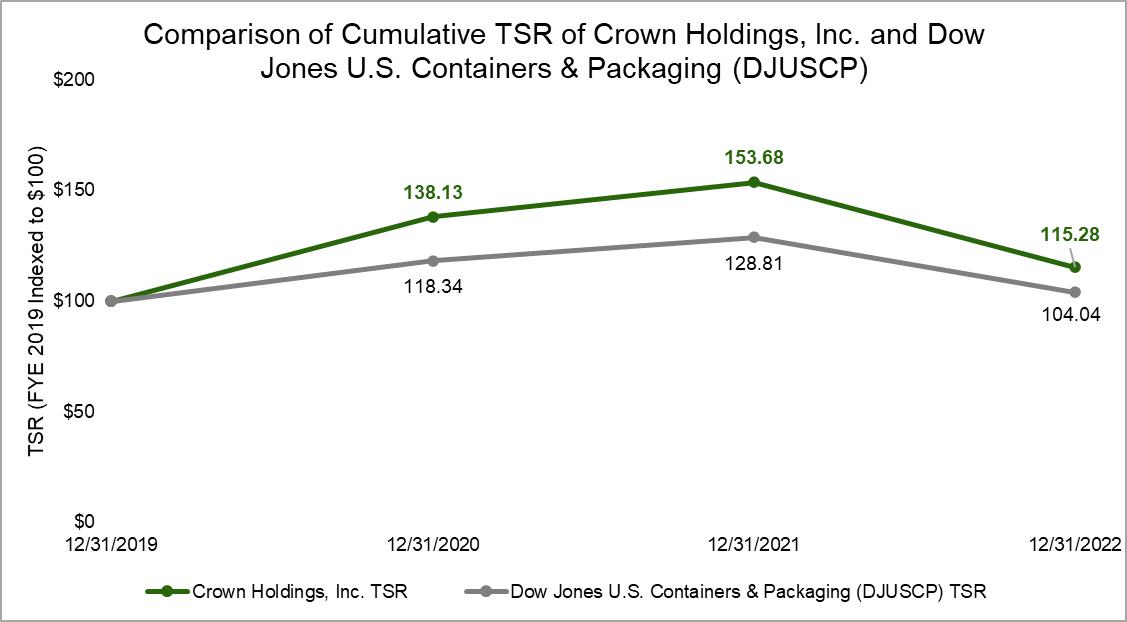

The Company has developed an executive compensation program that is ownership-oriented and that rewards the attainment of specific annual and long-term goals that will result in improvement in Shareholdershareholder value. Two-thirdsApproximately two-thirds of our NEOs'NEOs’ share awards are performance-based, and vesting has beenperformance-based. Vesting is based on two performance metrics: the Company'sCompany’s relative total shareholder return ("TSR"(“TSR”) against a peer group (and beginning with 2017 grants, also on(the Dow Jones U.S. Containers & Packaging Index) and the Company'sCompany’s return on invested capital as a second metric)(“ROIC”). CompanyAnnual incentive bonuses are also based on two performance relativemetrics: the Company’s modified operating cash flow (“MOCF”) and its economic profit.

Based on the Company’s over-performance for the measurement periods related to the peer group may resultvesting of performance-based shares in lower compensation2020, 2021, 2022 and 2023, the Company’s NEOs, including the CEO, received awards that were 21.3%, 48.5%, 62.6% and 25.7% above target. Based on the Company’s under-performance for the executives even whenmeasurement periods related to the Company experiences a positive TSR. For example, despite a positive TSRvesting of over 53% forperformance-based shares in 2018 and 2019, the five-year measurement period 2013 – 2017, because this return underperformed our industry peers, the Company'sCompany’s NEOs, including the CEO, forfeited 67%100% of the targeted vestings of performance-based shares awarded to them undershares. For 2022, based on the threeCompany’s under-performance on both the MOCF and economic profit components of the annual grants made with respect toincentive bonus, corporate-level NEOs (including the CEO) received bonuses that measurement period.were 63.5% below target. The Committee views these outcomes as demonstrative of the Company’s “pay-for-performance” philosophy.

| 10 |

| NEO FORFEITURE OF PERFORMANCE-BASED SHARES | |||

| Year of Grant | Performance Period | Year of Forfeiture | % of Shares Forfeited |

| 2013 | 2013 – 2015 | 2016 | 63% |

| 2014 | 2014 – 2016 | 2017 | 34% |

| 2015 | 2015 – 2017 | 2018 | 100% |

Elements of Total Direct Compensation

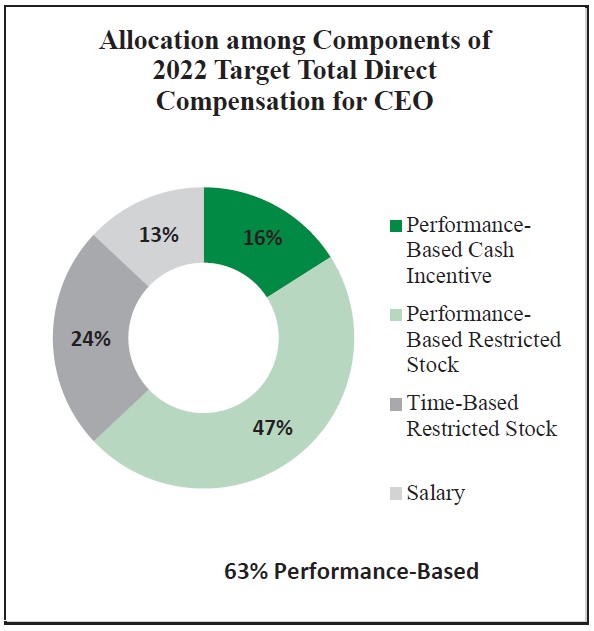

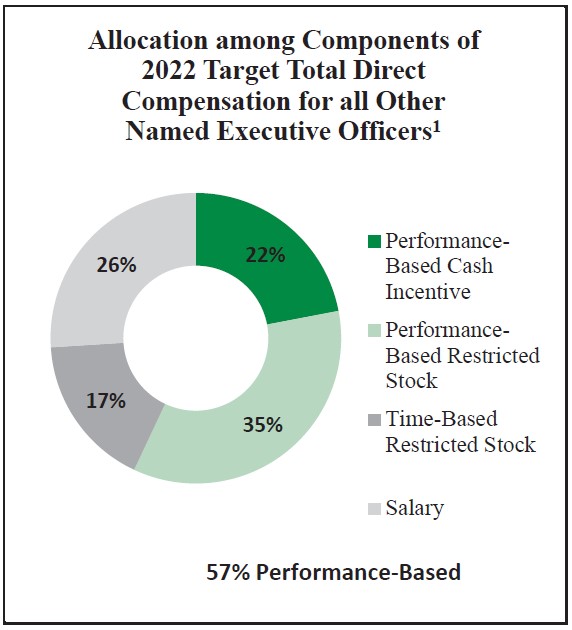

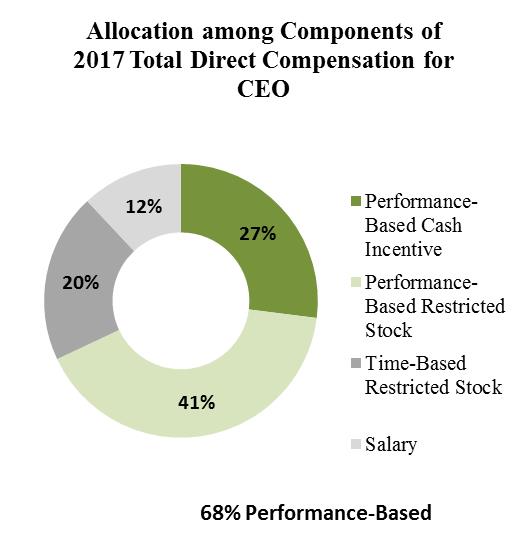

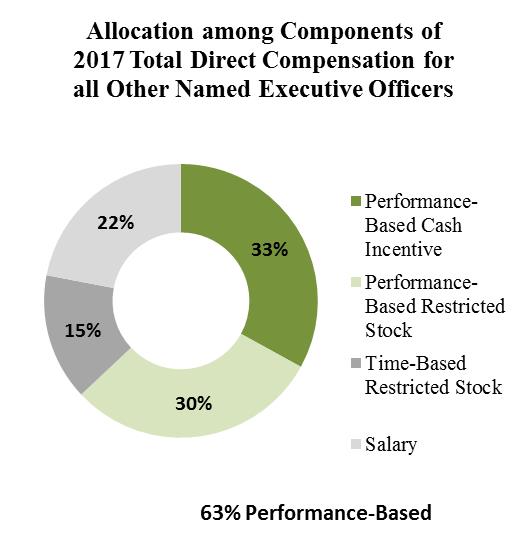

The allocation of 20172022 total direct compensation for our CEO and for our other NEOs among the various components of compensation is set forth in the following charts that highlight the Company'sCompany’s emphasis on "at risk"“at risk” and equity-based compensation.

|

|

| 11 |

|

Executive Compensation Best Practices

WHAT WE DO üBenchmark our üReview pay and performance alignment annually üTarget and provide a majority of the direct compensation paid to our NEOs in performance-based compensation üAllocate approximately two-thirds of compensation under the üVest performance-based shares on the basis of two metrics üBase payouts under the üMaintain stock üRecoup (“Clawback”) non-equity incentive bonus payments üEngage an independent compensation consultant for our Compensation Committee üAnnually review the independence of the compensation consultant retained by the Compensation Committee üUtilize tally sheets to review total compensation, compensation mix, internal pay equity, payouts under certain potential termination scenarios and the aggregate value of retirement benefits üHold annual üInclude a sustainability criterion for the Board’s annual evaluation of the CEO WHAT WE ûAllow carry-forward or banking of economic profit or modified operating cash flow achievement in ûUse subjective individual qualitative factors in determining ûInclude any tax gross-up provisions in ûProvide excessive perquisites ûPermit any form of hedging or pledging of Company stock |

Please read the CD&A, beginning on page 28,36, for a more detailed description of the Company'sCompany’s executive compensation program.

| 12 |

Proposal 4 -– Advisory Vote on Frequency of Future Say-on-Pay Votes

This Proposal affords Shareholders the opportunity to cast an advisory vote on how often we should include a Say-on-Pay vote in our proxy materials for future annual Shareholder meetings or any special Shareholder meeting for which we must include executive compensation information in the proxy statement for that meeting. Under this Proposal 4, Shareholders may vote to have the Say-on-Pay vote every year, every two years, or every three years.

The Board recommends you vote “Every Year” for the Say-on-Pay frequency proposal.

Proposal 5 – Consideration of Shareholder Proposal to Amend the Company's Existing Proxy Access By-Law

Mr. John Chevedden for the second consecutive year, has madeadvised he intends to present a Shareholder proposal requesting the Board to amendof Directors seek Shareholder approval of any senior manager’s new or renewed pay package that provides for severance or termination payments with an estimated value exceeding 2.99 times the Company's existing proxy access By-Law. Over 70%sum of the votes cast at the 2017 Annual Meeting voted against last year's proposal.

The Board has carefully considered this Shareholder proposal and believesrecommends that it is unnecessary and potentially detrimental to the Company and its Shareholders. Accordingly, the Board recommends ayou vote AGAINST Proposal 4.5.

| 13 |

QUESTIONS AND& ANSWERS ABOUT THE 20182023 ANNUAL MEETING

Why am I receiving these materials?

The Company is providing you this Proxy Statement, the accompanying Proxy Card and a copy of our Annual Report for the year ended December 31, 2017,2022, containing audited financial statements, in connection with our Annual Meeting of Shareholders or any adjournments or postponements of the Annual Meeting. The Meeting will be held on April 26, 201827, 2023 at 9:30 a.m. local timeEastern Time at the Company's Corporate HeadquartersThe Westin Tampa Waterside located at One Crown Way, Philadelphia, Pennsylvania.725 South Harbour Island Boulevard, Tampa, Florida. As a Shareholder of the Company, you are cordially invited to attend the Annual Meeting and are entitled and requested to vote on the matters described in this Proxy Statement. The accompanying Proxy is solicited on behalf of the Board of Directors of the Company. We are mailing this Proxy Statement and the accompanying Proxy Card and Annual Report to our Shareholders on or about March 19, 2018.

What is a Proxy?

A Proxy is your legal designation of another person to vote the shares that you own in accordance with your instructions. The person you appoint to vote your shares is also called a Proxy.Proxy Holder. On the Proxy Card you will find the names of the persons designated by the Company to act as ProxiesProxy Holders to vote your shares at the Annual Meeting. The Board is asking you to allow any of the persons named as ProxiesProxy Holders on the Proxy Card (all of whom are Officers of the Company) to vote your shares at the Annual Meeting. The ProxiesProxy Holders must vote your shares in the manner you instruct.

Who is entitled to vote?

Only Shareholders as of the close of business on March 6, 2018 ("7, 2023 (“Record Date"Date”) are entitled to receive notice of, to attend and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. Each Shareholder has one vote per share on all matters to be voted on. As of the Record Date, there were 134,301,833120,107,190 shares of Common Stock outstanding.

What is the difference between a "record owner"“record owner” and a "beneficial owner"“beneficial owner”?

Record Owners

: If your shares are registered directly in your name with EQ Shareowner Services, theBeneficial Owners

: If your shares are held in an account at a brokerage firm, bank or trust as custodian on your behalf, you are considered the| 14 |

What proposals will be voted on at the Annual Meeting?

Shareholders will vote on fourfive proposals at the Annual Meeting:

| · | the election of Directors |

| · | the ratification of the appointment of the |

| · | the “Say-on-Pay” vote |

| · | an advisory |

| · | if properly presented, a Shareholder proposal |

The Company also will consider any other business that properly comes before the Annual Meeting in accordance with Pennsylvania law and the Company'sCompany’s By-Laws.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote your shares:

| · |

| · |

| · |

| · |

| · | “AGAINST” the Shareholder proposal |

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a Proxy to the personsProxy Holders named on the Proxy Card, they will have the discretion to vote your shares in their best judgment with respect to any additional matters properly brought before the Annual Meeting in accordance with Pennsylvania law and the Company'sCompany’s By-Laws. Also, if for any reason any of our nominees are not available as candidates for Director, the persons named as ProxiesProxy Holders will vote the Proxies for any other candidate or candidates who may be nominated by the Board.

How do I vote my shares?

You may vote your shares by Proxy or in person.

You may vote by Proxy by:

| · |

by the Internet, at the web address provided on |

| · | by telephone, using the toll-free number listed on page 1 of this Proxy Statement or on your Proxy Card or voting instruction form; or |

| · | by mail, by marking, signing, dating and mailing your Proxy Card or |

| 15 |

You also may vote in person at the Annual Meeting. If you are a record owner, you need no prior authorization. If a brokerage firm, bank or trust holds your shares in street name, you must obtain a legal proxy from that firm before you can vote the shares in person at the Annual Meeting.

| · | with no prior authorization, if you are a record owner; |

| · | with a legal proxy from the brokerage firm, bank or trust that holds your shares in street name, if you are a beneficial owner. |

The deadline for voting by telephone or electronically through the Internet is 11:59 p.m. CentralEastern Time, April 25, 2018.

Will my shares be voted if I do not provide my Proxy?

It depends on whether you are a record owner or beneficial owner. If you are a record owner, your shares will NOT be voted unless you provide a Proxy or vote in person at the Annual Meeting. For beneficial owners who hold shares in street name through brokerage firms, those firms generally have the authority to vote their clients'clients’ unvoted shares in their discretion on certain routine matters. For example, if you are a beneficial owner and you do not provide voting instructions, your brokerage firm may vote your shares with respect to the ratification of the appointment of independent auditors (Proposal 2), as this matter is considered routine under the applicable New York Stock Exchange ("NYSE"(“NYSE”) rules. All other matters to be voted on at this year'syear’s Annual Meeting are not considered routine, and your broker voting on a routine matter cannot vote your shares on those non-routine matters without your instruction ("(“broker non-votes"non-votes”).

Beneficial Owners

: The Company urges you to instruct your broker, bank or trust on how to vote your shares.What constitutes a quorum?

The presence, in person or by Proxy, of Shareholders entitled to cast a majority of votes will be necessary to constitute a quorum for the transaction of business at the Annual Meeting. WITHHOLD votes with respect to Director nominees and ABSTAINabstain votes will be counted in determining the presence of a quorum as well as shares subject to broker non-votes if the broker votes the shares on a routine matter, such as the ratification of the appointment of the Company'sCompany’s independent auditors (Proposal 2).

Under Pennsylvania law and the Company'sCompany’s By-Laws, ABSTAIN votes and broker non-votes are not considered to be "votes cast"“votes cast” and, therefore, although they will be counted for purposes of determining a quorum, they will not be given effect either as FOR or WITHHOLD / AGAINST votes or as votes on the frequency of the Company’s Say-on-Pay votes.

What vote is needed for the election of Directors, and what is the policy with respect to the resignation of Directors who do not receive a majority of the votes?

With regard to Proposal 1, Shareholders may vote FOR or WITHHOLD with respect to the election of Directors. Directors are elected by a plurality of the votes cast, in person or by Proxy, subject to the Company'sCompany’s By-Law provision described below. The Company'sCompany’s By-Laws set forth the procedures if a Director nominee does not receive at least a majority of votes cast in an uncontested election of Directors where a quorum is present. In an uncontested election, an incumbent Director nominee who receives the support of less than a majority of the votes cast at an Annual Meeting, although deemed to have been elected to the Board by plurality vote, must promptly tender his or her resignation to the Board. In an uncontested election, if a nominee who is not an incumbent does not receive the vote of at least a majority of the votes cast, the nominee will be deemed to have been elected to the Board by plurality vote and to have immediately resigned.

For this purpose, "majority“majority of votes cast"cast” means the number of shares voted FOR a Director'sDirector’s election exceeds 50% of the total number of votes cast with respect to the Director'sDirector’s election. "Votes cast"“Votes cast” includes only FOR and WITHHOLD votes. Under Pennsylvania law and the Company'sCompany’s By-Laws, ABSTAIN votes and broker non-votes are not considered to be "votes"“votes” and, therefore, will not be given effect either as FOR or WITHHOLD votes.votes in the context of Proposal 1.

| 16 |

The Nominating and Corporate Governance Committee will evaluate the tendered resignation of an incumbent Director who does not receive a majority vote in an uncontested election and make a recommendation to the Board as to whether the resignation should be accepted. The Board will act on the tendered resignation and publicly disclose its decision within 90 days from the date of

What vote is needed to approve all other proposals?

Proposals 2, 3 and 45 require a FOR vote of a majority of the votes cast, in person orand by Proxy, in order to be approved.

ABSTAIN votes and broker non-votes will not be considered as votes cast and will have no effect on the outcome of the votes on these proposals.

Can I change or revoke my vote after I have delivered my Proxy?

Yes. If you are a record owner, prior to the Annual Meeting you may change your vote by submitting a later-dated Proxy in one of the manners authorized and described in this Proxy Statement (by Proxy Card, via the Internet or by telephone). You also may give a written notice of revocation to ourthe Company’s Corporate Secretary, so long as it is delivered to ourthe Corporate Secretary at ourthe Company’s principal executive offices prior to the beginning of the Annual Meeting, or given to ourthe Corporate Secretary at the Annual Meeting prior to the time your Proxy is voted at the Annual Meeting. You also may revoke any Proxy given pursuant to this solicitation by attending the Annual Meeting and voting in person by ballot. If you are a beneficial owner, please follow the instructions provided by your broker, bank or trust as to how you may change your vote or obtain a legal proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Who can attend the Annual Meeting?

Only Company employees and Shareholders as of the March 6, 20187, 2023 Record Date may attend the Annual Meeting. Record owners may attend without any prior authorization. If you are a beneficial owner, to be admitted to the Annual Meeting you will need proof of beneficial ownership satisfactory to the Company in the form of a statement from the brokerage firm, bank or trust or a legal proxy from that institution showing you as a beneficial owner of Company shares or as the sole legal proxy of a beneficial owner. All Annual Meeting attendees may be asked to present valid, government-issued photo identification, such as a driver'sdriver’s license or passport, before entering the Annual Meeting. Attendees will be subject to security inspections and will be required to comply with other security and procedural measures in place at the Annual Meeting. Please arrive early enough to allow yourself adequate time to clear security. You will not be allowed to use video or audio recording devices in the Annual Meeting. Representatives of the Company will be at the entrance to the Annual Meeting, and these representatives will be authorized on the Company'sCompany’s behalf to determine whether the admission policies and procedures are being followed and whether you will be granted admission to the Annual Meeting.

COVID-19 Protocols:

For the health and safety of our Shareholders and employees, we ask that you follow all applicable health orders related to the COVID-19 pandemic in place at the time of the Annual Meeting. As the state of the COVID-19 pandemic and applicable health orders are subject to change following the date of this Proxy Statement, we encourage Shareholders who

| 17 |

plan to attend the Annual Meeting in person to review the latest guidance from the Centers for Disease Control and Prevention and the Florida Department of Health, as well as the Company’s website at:

www.crowncork.com/investors/governance/proxy-online

prior to attending. Individuals experiencing cold/flu-like symptoms, or any other symptoms associated with COVID-19, should not attend the Annual Meeting in person but are encouraged to vote prior to the meeting using one of the other methods described under “How do I vote my shares?” above.

Where can I find voting results of the Annual Meeting?

The Company will announce the preliminary voting results at the Annual Meeting and publish the final results in a Form 8-K or Form 10-Q filed with the Securities and Exchange Commission ("SEC"(“SEC”) within four business days after the date of the Annual Meeting.

Who conducts the Proxy solicitation, and how much will it cost?

The Company has engaged D.F. King & Co., Inc. to assist in the solicitation of Proxies for a fee of $10,000 plus reimbursement for out-of-pocket expenses and certain additional fees for services rendered in connection with such solicitation. Certain Officers and employees of the Company may also solicit Proxies by mail, telephone, internetInternet or facsimile or in person without any extra compensation. The Company bears the cost of soliciting Proxies.

What is the deadline for proposals for consideration or for nominations of individuals to serve as Directors at the 20192024 Annual Meeting of Shareholders?

Proposals to be Considered for Inclusion in the Company'sCompany’s Proxy Materials:

In order to be considered for inclusion in the Proxy Statement for the Company's 2019Company’s 2024 Annual Meeting of Shareholders, any Shareholder proposal intended to be presented at that meeting, in addition to meeting the shareholder eligibility and other requirements of the SEC rules governing such proposals, must be received in writing, via Certified Mail – Return Receipt Requested, by the Office of the Corporate Secretary, Crown Holdings, Inc., One Crown Way, Philadelphia, PA 19154Hidden River Corporate Center Two, 14025 Riveredge Drive, Suite 300, Tampa, FL 33637 not later than November 19, 2018. The Company anticipates a relocation of its principal executive office in 2018, so proposals sent after the relocation should be sent to such other address constituting the Company's principal executive office as may be designated in a subsequent SEC filing.

Director Nominations for Inclusion in the Company'sCompany’s Proxy Materials (Proxy Access):

Under certain circumstances, Shareholders may submit nominations for Directors for inclusion in the Company'sCompany’s proxy materials by complying with the proxy access requirements in the Company'sCompany’s By-Laws, which require nominations to be submitted in writing, via Certified Mail – Return Receipt Requested, and received at the above address not before October 20, 201822, 2023 nor after November 19, 2018.

Other Business and Director Nominations to Be Brought Before the 20192024 Annual Meeting of Shareholders:

The Company'sCompany’s By-Laws currently provide that a Shareholder of record at the time that notice is given to the Company and who is entitled to vote at an annual meeting may bring business before the meeting or nominate a person for election to the Board of Directors if the Shareholder gives timely notice of such business or nomination. To be timely, and subject to certain exceptions, notice in writing to the Corporate Secretary must be delivered or mailed, via Certified Mail – Return Receipt Requested, and received at the above address not before October 20, 201822, 2023 nor after November 19, 2018.21, 2023. The notice must describe various matters regarding the nominee or proposed business. Any Shareholder desiring a copy of the Company'sCompany’s By-Laws will be furnished one copy without charge upon written request to the Corporate Secretary.

| 18 |

How can I access the Proxy materials overon the Internet?

The Company has made available copies of the following materials at the Company'sCompany’s website at:

https://www.crowncork.com/investors/governance/proxy-online

| · | this Proxy Statement |

| · | the Proxy Card relating to the Annual Meeting of Shareholders |

| · | the Annual Report to Shareholders |

Information included on the Company'sCompany’s website, other than this Proxy Statement, the Proxy Card and the Annual Report to Shareholders, is not part of the Proxy soliciting materials.

Whom should I contact to obtain a copy of the Annual Report on Form 10-K?

The Company filed its Annual Report on Form 10-K for the fiscal year ended December 31, 20172022 with the SEC on February 26, 2018.27, 2023. A copy of the Company'sCompany’s Annual Report on Form 10-K was included as part of the Annual Report to Shareholders that you received along with the proxy materials. Any Shareholder can obtain a copy of the Annual Report, including the financial statements and schedules thereto and a list describing all the exhibits not contained therein, without charge. Requests for copies of the Annual Report should be sent to: Investor Relations Department, Crown Holdings, Inc., One Crown Way, Philadelphia, PA 19154 (or such other address constitutingHidden River Corporate Center Two, 14025 Riveredge Drive, Suite 300, Tampa, FL 33637 or you may call toll free 888-400-7789. Copies in electronic format of the Company's principal executive office as may be designatedCompany’s Annual Report and filings with the SEC are available at the Company’s website at www.crowncork.com/investors/reports-filings in a subsequent SEC filing).the “For Investors” section.

| 19 |

PROPOSAL 1: ELECTION OF DIRECTORS

The persons named in the Proxy Holders shall vote the shares forwith respect to the nominees listed below, all of whom are now Directors of the Company, to serve as Directors for the ensuing year or until their successors shall be elected. None of the persons named as a nominee for Director has indicated that he or she will be unable or will decline to serve. In the event that any of the nominees are unable or decline to serve, which the Nominating and Corporate Governance Committee of the Board of Directors does not believe will happen, the persons named in the Proxy Holders will vote forwith respect to the remaining nominees and others who may be nominated by the Board of Directors.

The By-Laws of the Company provide for a Board of Directors consisting of between 10 and 18 Directors, as determined by the Board of Directors. The Board of Directors has fixed the number of Directors at 12.13. It is intended that the Proxies will be voted for the election of the 1213 nominees named below as Directors, and no more than 1213 will be nominated by the Board.

The Board is committed to regular review of the Board'sits composition to ensure that the Board continues to have the right mix of skills, background and tenure. Eight of the Company’s independent Directors have joined the Board in the last five years as a result of a Board refreshment process where Director candidates were identified through Board, Shareholder and third-party search firm input. Our ongoing Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. The Board believes that the collective combination of backgrounds, skills and experiences of its members has produced a Board that is well-equipped to exercise oversight responsibilities for the Company'sCompany’s Shareholders and to help guide the Company to achieve its long-term strategic objectives.

On December 12, 2022, the Company entered into a Director Appointment and Nomination Agreement with Carl C. Icahn and the persons and entities listed therein (collectively, the “Icahn Group”), pursuant to which the Company agreed to (i) increase the size of the board of directors of the Company to 13 directors and (ii) appoint Andrew J. Teno and Jesse A. Lynn (collectively, the “Icahn Designees”) to the Board to fill the resulting vacancies and include each of the Icahn Designees as part of the Company’s slate of nominees for election to the Board at the 2023 Annual Meeting of Shareholders. A summary of the terms of the Director Nomination Agreement is provided in the “Transactions with Related Persons” section on page 34.

Under the Company’s Corporate Governance Guidelines, no Director will commence a term of Board service if the Director is over 75 years old unless the Board determines that an additional term of Board service would be in the best interests of the Company.

The names of thethis year’s nominees and information concerning them and their associations as of March 6, 2018,7, 2023, as furnished by the nominees, follow. The principal occupations and the directorships stated include the nominees'nominees’ occupations and directorships with any U.S. publicly traded companies or registered investment companies during the last five years.

The Board of Directors Recommends that Shareholders Vote FOR

of Each of the Nominees Named Below.

| Name | Age | Principal Occupation | Year Became Director |

John W. Conway (a) | 72 | Chairman of the Board and former Chief Executive Officer of the Company; also a Director of PPL Corporation | 1997 |

Timothy J. Donahue (a) | 55 | President and Chief Executive Officer of the Company | 2015 |

Arnold W. Donald (c) | 63 | President, Chief Executive Officer and Director of Carnival Corporation; former President and Chief Executive Officer of The Executive Leadership Council; also a Director of Bank of America Corporation and a former Director of The Laclede Group and Oil-Dri Corporation of America | 1999 |

Andrea J. Funk (b) | 48 | Former Chief Executive Officer of Cambridge-Lee Industries | 2017 |

Rose Lee (b) | 52 | President of DuPont Safety & Construction; former officer of several Saint-Gobain companies | 2016 |

William G. Little (a) (c) (d) | 75 | Former Chairman and Chief Executive Officer of West Pharmaceutical Services | 2003 |

Hans J. Löliger (a) (c) (d) | 75 | Vice Chairman of GTF Holding; former Chief Executive Officer of SICPA Group | 2001 |

James H. Miller (d) | 69 | Former Chairman and Chief Executive Officer of PPL Corporation; also a Director of AES Corporation and Chicago Bridge & Iron Company; former Director of Lehigh Gas Partners and Rayonier Advanced Materials | 2010 |

Josef M. Müller (b) (c) | 70 | Former President of Swiss Association of Branded Consumer Goods "PROMARCA"; former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 2011 |

Caesar F. Sweitzer (b) | 67 | Former Senior Advisor and Managing Director of Citigroup Global Markets | 2014 |

Jim L. Turner (c) (d) | 72 | Principal of JLT Beverages; former Chairman, President and Chief Executive Officer of Dr Pepper/Seven Up Bottling Group; also Chairman of Dean Foods and a Director of Comstock Resources | 2005 |

William S. Urkiel (b) (d) | 72 | Former Senior Vice President and Chief Financial Officer of IKON Office Solutions; also a Director of Roadrunner Transportation Systems | 2004 |

| Name | Age | Principal Occupation | Year Became Director | |

Timothy J. Donahue (e) | 60 | Chairman, President and Chief Executive Officer of the Company | 2015 | |

Richard H. Fearon (a) (ncg) | 66 | Former Vice Chairman and Chief Financial and Planning Officer and Director of Eaton Corporation; also a Director of Avient Corporation and CRH plc | 2019 | |

Andrea J. Funk (a) (c) | 53 | Executive Vice President and Chief Financial Officer of EnerSys; former Chief Executive Officer of Cambridge-Lee Industries; former Director of Destination Maternity Corporation | 2017 | |

Stephen J. Hagge (c) (e) (ncg) | 71 | Former President, Chief Executive Officer and Director of AptarGroup; also Chairman of CF Industries Holdings | 2019 | |

Jesse A. Lynn (ncg) | 52 | General Counsel of Icahn Enterprises and Chief Operating Officer of Icahn Capital; also a Director of Conduent, FirstEnergy and Xerox Holdings; former Director of Cloudera, Herbalife Nutrition and Manitowoc | 2022 | |

James H. Miller (c) (e) (ncg) | 74 | Former Chairman and Chief Executive Officer of PPL Corporation; also a Director of AES Corporation | 2010 | |

Josef M. Müller (a) (c) | 75 | Former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 2011 | |

B. Craig Owens (a) (e) | 68 | Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company; also a Director of AptarGroup; former Director of J C Penney Company | 2019 | |

Angela M. Snyder (a) | 58 | Senior Executive Vice President/Chief Banking Officer of Fulton Bank | 2022 | |

Caesar F. Sweitzer (a) (e) (ncg) | 72 | Former Senior Advisor and Managing Director of Citigroup Global Markets | 2014 | |

Andrew J. Teno (a) (c) | 37 | Portfolio Manager of Icahn Capital; former Director at Fir Tree Partners; also a Director of FirstEnergy and Southwest Gas; former Director of Cheniere Energy, Eco-Stim Energy and Herc Holdings | 2022 | |

Marsha C. Williams (c) | 71 | Former Senior Vice President and Chief Financial Officer of Orbitz Worldwide; also Chairperson of Modine Manufacturing Company and a Director of Fifth Third Bancorp | 2022 | |

Dwayne A. Wilson (a) | 64 | Former Senior Vice President of Fluor Corporation; also a Director of Sterling Construction Company, Ingredion Incorporated and DT Midstream; former Director of AK Steel Holding Corporation | 2020 | |

| (a) Member of the Audit Committee | (c) Member of the Compensation Committee | |||

| (e) Member of the Executive Committee | (ncg) Member of the Nominating and Corporate Governance Committee | |||

| 21 |

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to become members of the Board of Directors and recommending candidates to the Board as Director nominees. The Board desires a diverse membership, including with respect to race, gender, nationality and ethnicity as well as professional background and geographic and industry experience. The Nominating and Corporate Governance Committee assesses each potential nominee'snominee’s overall mix of experiences, qualifications, perspectives, talents, education and skills as well as each potential nominee'snominee’s ability to contribute to the Board and to enhance the Board'sBoard’s decision-making process.processes. Independence is a key factor when considering the Director nominees, as are critical thinking skills, practical wisdom and mature judgment in the decision-making process. For a description of the identifying and evaluating procedures of the Nominating and Corporate Governance Committee, see "Corporate“Corporate Governance – Nominating and Corporate Governance Committee."” The Board believes that each of the nominees listed above has the sound character, integrity, judgment and record of achievement necessary to be a member of the Board and is independent of the influence of any particular Shareholder or group of Shareholders whose interests may diverge from the interests of the Company's Shareholders as a whole.Board. In addition, each of the nominees has exhibited during his or her prior service as a Director, the ability to operate cohesivelyconstructively with the other members of the Board and to challenge and question management in a constructiveproductive way.

The Board believes, moreover, that each nominee brings a strong and unique background and skill set to the Board, giving the Board, as a whole, competence and experience in diverse areas. These areas include organizational leadership; public company board service; manufacturing; finance; management in the packaging, food and beverage sectors and other relevant industries; and international business and markets.markets; information security; and experience representing the views of investors. The Board believes that the following specific experiences, qualifications and skills, together with the aforementioned attributes, qualify each of the nominees listed above to serve as a Director.

Timothy Donahue

. Mr. Donahue was elected Chairman by the Board following the 2022 Annual Meeting and assumed the position of CEO of the CompanyRichard Fearon. Mr. Donald,Fearon, the Company's longest-serving Independent Director,former Vice Chairman and CFO of an NYSE-listed global, diversified manufacturing company, brings to the Board leadershipcomprehensive knowledge of financial accounting and otherextensive experience in financial reporting, corporate finance and capital markets, corporate development, strategic planning, mergers and acquisitions, risk management and investor relations. He also oversaw his company’s information security program for more than 10 years and chaired its senior management committee on information security. Mr. Fearon’s experience and a deep understandingqualifies him as an “audit committee financial expert” within the meaning of the food industry from his prior role as chairman and CEO of a food industry company. As the active CEO of a public S&P 500 company, Mr. Donald provides expertise regarding management of a large multi-national enterprise.SEC regulations. In addition, his service as Lead Director of an NYSE-listed global provider of specialized polymers also provides significant governance experience. Mr. Donald's broad experience in corporate governanceFearon also serves as a CEO and director past and present, of a number of otheranother NYSE-listed companies in various industries brings a valuable added dimension to the Board.

Andrea Funk

. Ms.Stephen Hagge. Ms. LeeMr. Hagge brings to the Board a deep knowledge of operations, engineeringsubstantial leadership and technology from hermanagement experience in engineeringpublic company governance, operations, international business, strategic initiatives and information technology. Sherisk management from his roles as former CEO, CFO and COO of an NYSE-listed global packaging manufacturer. Mr. Hagge chairs the Compensation Committee and also brings a broad global perspective from her roleserves as presidentChairman of another NYSE-listed company.

| 22 |

Jesse Lynn. Mr. Lynn’s extensive experience, since 2004, as general counsel or assistant general counsel of a global business segmentdiversified holding company engaged in a variety of an international manufacturing company.

James Miller. Mr. Löliger's experience as president of a global packaging company and CEO of a global provider of security inks and integrated security solutionsMiller, the Company’s Independent Lead Director, brings to the Board a seasoned understanding of global business and positioning. Mr. Löliger, a European national, serves as vice chairman and director of several non-U.S. companies, giving the Board, the Nominating and Corporate Governance Committee and the Compensation Committee a distinct viewpoint on corporate governance and executive compensation.

Josef Müller

. Mr. Müller, a European national, has over 35 years of senior management experience at a global food and beverage company, including as the CEO of thatB. Craig Owens. Mr. Owens’ extensive experience in the consumer food and beverage industries, including his former service as the CFO of a leading NYSE-listed international consumer food company, brings to the Board significant financial expertise, including all aspects of financial reporting, accounting, corporate finance and capital markets, as well as significant experience in strategic planning, business integration and operations, and in managing supply chain organizations. In his roles as CFO for several companies, he had over 15 years of senior-level management responsibility for information security. He also recently completed a Director-level certification course in information security. Mr. Owens also has considerable knowledge of the retail industry having served as CFO of a leading international grocery retailer. His experience qualifies him as an “audit committee financial expert” within the meaning of SEC regulations, and he chairs the Audit Committee. Mr. Owens also serves as a director of another NYSE-listed company.

Angela Snyder. Ms. Snyder brings to the Board extensive experience in the banking sector and proven senior executive leadership experience from her roles as Chairwoman, President and CEO of a former subsidiary of a NASDAQ-listed financial holding company. She possesses more than 30 years of experience in the financial services industry.

Caesar Sweitzer

. Mr. Sweitzer spent over 35 years in finance, primarily as an investment banker focusing on industrial companies. Mr. Sweitzer brings to the Board significant knowledge of the global packaging industry as well as finance and investment matters, such as acquisitions, dispositions and corporate finance. Mr.Andrew Teno. Mr. Turner's extensive experience in the soft drink industry, and in particular his experience as owner and CEO of the largest independent soft drink bottler in the U.S., gives the Board deep insight into the industry of many of the Company's significant customers. Mr. Turner has valuable experience in business development, finance and mergers and acquisitions. Mr. Turner also chairs the board of a NYSE-listed food and beverage company.

| 23 |

Marsha Williams. Ms. Williams brings to the Board extensive experience in strategic planning, corporate finance, operations, mergers and comprehensive knowledge of accounting, financeacquisitions, investor relations, information technology, liquidity management, risk management and corporate governance matters. Mr. Urkiel's accountingthrough her prior roles as Chief Financial Officer and finance experience qualify him as an "audit committee financial expert" within the meaningChief Administrative Officer of SEC regulations, and he serves on the Audit Committee. Mr. Urkielcompanies in diverse industries. Ms. Williams also serves as Chairperson of one publicly-listed company and as a director of another with global operations. In these roles, Ms. Williams has accumulated extensive knowledge of corporate governance, global finance, capital management, internal controls and human resources, including significant experience in the financial markets in which the Company competes for financing.

Dwayne Wilson. Mr. Wilson brings to the Board over 36 years of senior management experience at a leading NYSE-listed construction and engineering company. Mr. Wilson has gained a broad range of experience and exposure to a number of diverse end markets, and the Company benefits from his knowledge and perspective, particularly in the areas of manufacturing, technology, operational excellence and engineering. Mr. Wilson also serves as a director of three other publicly-listed companies.

| 24 |

DIRECTOR COMPENSATION

The following table lists 20172022 Director compensation for all Non-Employeeindependent Directors who servedreceived compensation as Directors in 2017.2022. Compensation for Mr. Donahue, the Company'sCompany’s Chief Executive Officer, is reported in the Summary Compensation Table included in the Executive Compensation section below. Mr. Donahue diddoes not earn additional compensation for his service as Director.Director or for his service as Chairman.

Name | Fees Earned or Paid in Cash (1) |

Stock Awards (2) |

Total |

| John Conway (3) (4) | $90,000 | $80,000 | $170,000 |

| Richard Fearon | 122,500 | 160,000 | 282,500 |

| Andrea Funk | 125,000 | 160,000 | 285,000 |

| Stephen Hagge | 125,000 | 160,000 | 285,000 |

| Rose Lee (3) | 27,500 | 40,000 | 67,500 |

| James Miller | 155,000 | 160,000 | 315,000 |

| Josef Müller | 125,000 | 160,000 | 285,000 |

| B. Craig Owens | 125,000 | 160,000 | 285,000 |

| Angela Snyder | 28,750 | 40,000 | 68,750 |

| Caesar Sweitzer | 125,000 | 160,000 | 285,000 |

| Jim Turner (3) | 65,000 | 80,000 | 145,000 |

| William Urkiel (3) | 55,000 | 80,000 | 135,000 |

| Marsha Williams | 82,500 | 120,000 | 202,500 |

| Dwayne Wilson | 115,000 | 160,000 | 275,000 |

(1) Each Director may defer receipt of all, or any part, of his or her cash compensation until termination of service as a Director. Effective 2024, a Director may defer his or her cash compensation to a fixed payment date that is before or after the Director’s termination of service. At the election of the Director, deferred cash compensation amounts are paid in either a lump sum or installments over a period not to exceed 10 years and are credited with interest at the prime rate until distributed. (2) The annual grant of Company Common Stock for 2022 consisted of $160,000 of Company Common Stock under the Stock Compensation Plan for Non-Employee Directors and was paid on a quarterly basis. The number of shares paid each quarter is determined based on the average of the closing market price of the Company’s Common Stock on each of the second through sixth business days following the date on which the Company publicly released its quarterly results. (3) Messrs. Conway, Turner and Urkiel retired as Directors of the Company in April 2022. Ms. Lee resigned as a Director of the Company in February 2022. (4) Mr. Conway received $40,000 in cash compensation as the Company’s Non-Executive Board Chairman in 2022. | |||

| 25 |

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total |

| Jenne Britell (3) | $60,000 | $90,000 | $150,000 |

| John Conway | 180,000 | 120,000 | 300,000 |

| Arnold Donald | 107,000 | 120,000 | 227,000 |

| Andrea Funk (4) | 25,000 | 30,000 | 55,000 |

| Rose Lee | 110,000 | 120,000 | 230,000 |

| William Little | 147,000 | 120,000 | 267,000 |

| Hans Löliger | 127,000 | 120,000 | 247,000 |

| James Miller | 107,000 | 120,000 | 227,000 |

| Josef Müller | 115,250 | 120,000 | 235,250 |

| Thomas Ralph (5) | 58,500 | 60,000 | 118,500 |

| Caesar Sweitzer | 115,000 | 120,000 | 235,000 |

| Jim Turner | 112,250 | 120,000 | 232,250 |

| William Urkiel | 115,250 | 120,000 | 235,250 |

(1) Each Director may defer receipt of all, or any part, of his or her cash compensation until termination of service as a Director. At the election of the Director, deferred cash compensation amounts are paid in either a lump sum or installments over a period not to exceed 10 years after departure from the Board and are credited with interest at the prime rate until distributed. (2) The annual grant of Company Common Stock for 2017 consisted of $120,000 of Company Common Stock under the Stock Compensation Plan for Non-Employee Directors and was paid on a quarterly basis. The number of shares paid each quarter is determined based on the average of the closing market price of the Company's Common Stock on each of the second through sixth business days following the date on which the Company publicly released its quarterly results. (3) Dr. Britell resigned as a Director of the Company in July 2017. (4) Ms. Funk was elected to the Board in July 2017. (5) Mr. Ralph retired as a Director of the Company in April 2017. | |||

The Board periodically receives benchmarking data regarding director compensation from Pay Governance the Board'sLLC, an executive compensation consulting firm. Data provided during 2017 indicated that the Company's Director compensation was belowfirm, and uses the 50th percentile of bothits peer groupgroup’s target total cash compensation and general industry data. Based on this review, the Board determined to set Directortarget total direct compensation for 2018 at the same level as a market check in 2017, with these adjustments: the annual equity grant was increased from $120,000 to $135,000, and the annual Audit Committee Chair and Presiding Director fees were both increased from $20,000 to $25,000. Accordingly, effective January 1, 2018,determining director compensation. For 2023, Directors who are not employees of the Company will receive annual cash base fees, grants of Company Common Stock and cash committee fees in the amounts set forth as follows.

| Cash Base Fee | $100,000 |

| Equity Grant | |

| Supplemental Cash Committee Fees: | |

·Audit Committee - Chair | 25,000 |

| ·Audit Committee - Other Members | 15,000 |

| ·Compensation Committee and Nominating and Corporate Governance Committee - Chair | 20,000 |

| ·Compensation Committee and Nominating and Corporate Governance Committee - Other Members | 10,000 |

| 25,000 |

Directors do not receive any additional fees for their service on the Executive Committee. There are no Board or committee meeting attendance fees. Directors are reimbursed by the Company for travel and related expenses they incur in connection with their service on the Board and its committees.

Under the Company’s Corporate Governance Guidelines, after five years of service on the Board, independent Directors are expected to own Company Common Stock having a

| 26 |

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND EXECUTIVE OFFICERS

The following table shows, as of March 6, 2018,7, 2023, the number of shares of Company Common Stock beneficially owned by each person or group that is known to the Company to be the beneficial owner of more than 5% of the Company'sCompany’s outstanding Common Stock.

Name and Address

| Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1)

|

The Vanguard Group (2) 100 Vanguard Blvd. Malvern, PA 19355 | 11,449,276 | 9.5% |

Icahn Partners Master Fund LP, Icahn Offshore LP, Icahn Partners LP, Icahn Onshore LP, Icahn Capital LP, IPH GP LLC, Icahn Enterprises Holdings L.P., Icahn Enterprises G.P. Inc., and Beckton Corp. (3) 16690 Collins Avenue, PH-1 Sunny Isles Beach, FL 33160 Matsumura Fishworks LLC (3) 312 Walnut Street, Suite 2000 Cincinnati, OH 45202 Carl C. Icahn (3) c/o Icahn Associates Holding LLC 16690 Collins Avenue, PH-1 Sunny Isles Beach, FL 33160 | 10,201,273 | 8.5% |

BlackRock, Inc. (4) 55 East 52nd Street New York, NY 10055 | 6,642,300 | 5.5% |

Janus Henderson Group plc (5) 201 Bishopsgate EC2M 3AE United Kingdom | 6,443,206 | 5.4% |

| 27 |

Name and Address | Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1) |

The Vanguard Group (2) 100 Vanguard Blvd. Malvern, PA 19355 | 11,666,070 | 8.7% |

Massachusetts Financial Services Company (3) 111 Huntington Avenue Boston, MA 02199 | 9,299,396 | 6.9% |

BlackRock, Inc. (4) 55 East 52nd Street New York, NY 10055 | 6,890,789 | 5.1% |

(1) Percentages are derived based upon 134,301,833 shares of Common Stock outstanding as of March 6, 2018. (2) The Vanguard Group, an investment advisor, reported that it may be deemed to be the beneficial owner of 11,666,070 shares of the Company's Common Stock. The Vanguard Group reported that it had sole dispositive power with respect to 11,538,435 shares, including 102,086 shares for which it had sole voting power and 36,675 shares for which it had shared voting power, and shared dispositive power with respect to 127,635 shares. (3) Massachusetts Financial Services Company, an investment advisor, reported that it may be deemed to be the beneficial owner of 9,299,396 shares of the Company's Common Stock. Massachusetts Financial Services Company reported that it had sole dispositive power with respect to 9,299,396 shares, including 8,321,986 shares for which it had sole voting power. (4) BlackRock, Inc., a parent holding company, reported that it may be deemed to be the beneficial owner of 6,890,789 shares of the Company's Common Stock. BlackRock, Inc. reported that it had sole dispositive power with respect to 6,890,789 shares, including 6,028,092 shares for which it had sole voting power. | ||

(1) | Percentages are derived based upon 120,107,190 shares of Common Stock outstanding as of March 7, 2023. |

(2) | The Vanguard Group, an investment advisor, reported that it may be deemed to be the beneficial owner of 11,449,276 shares of the Company’s Common Stock. The Vanguard Group reported that it had sole dispositive power with respect to 11,282,303 shares, including 76,613 shares for which it had shared voting power, and shared dispositive power with respect to 166,973 shares. |

(3) | The Icahn Group may be deemed to be the beneficial owner, in the aggregate, of 10,201,273 shares of Common Stock. Of such shares of Common Stock, an aggregate of 1,040,100 shares of Common Stock were acquired by Icahn Partners, Icahn Master and Matsumura in open market purchases. The remaining 9,161,173 shares of Common Stock may be deemed beneficially owned by the Icahn Group as a result of their having entered into forward contracts with respect to such number of shares of Common Stock. |